Over the past 2 years, more people have been leaving employment and turning to freelance or contracting. People have been reassessing their work/life balance, reprioritising, branching out into new interests and careers.

As so many people are joining the world of self-employment, I figured it was time for me to put my experiences across, to maybe help people consider the realities of being self-employed.

In 2017 I was told I could either reapply for my job or take redundancy. I had never been out of work (since I was 14 years old), I needed to reassess decide what I wanted to do next.

I had thought about self-employment for years, that was the dream, the ultimate goal. But what does it really mean? Well, there are several types of self-employment and I’ve dipped my toe in most of them over the past few years so if you are thinking about taking the plunge, read this first.

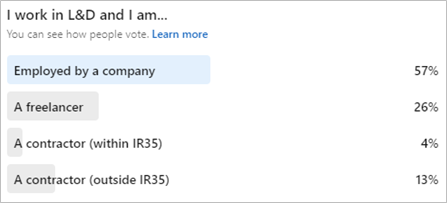

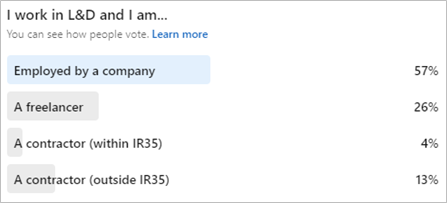

Before we start, I did a poll on LinkedIn to see what the spread of self-employment was. Most were employed, but it got me wondering how many people dream of working for themselves.

Employed

Let’s set the baseline, if you are employed by a company in the UK there can be quite a few benefits. These include:

- At least a minimum or living wage

- A pension with contributions from the company

- Holiday pay

- Sick pay

- Maternity/paternity pay

- Your tax and National Insurance (NI) contributions are automatically deducted if you are paid PAYE

- Additional benefits like a gym membership, car/travel allowance, shopping vouchers, etc.

Now let’s look at the different types of self-employment:

Freelancing

An article from Indeed states that freelancers are:

“a non-permanent, self-employed worker who provides products and services to multiple organisations. These professionals can work for as many clients and take on as many projects as their schedule allows. As a freelancer, you can set your own rates, process tax payments independently, and choose where to work.”

There are lots of pros and cons to being a freelancer, and some of them will depend on your field and circumstances. For example, you need to keep a record of your incomings and outgoings then submit these to HMRC each year. Then you’ll receive your tax and NI bill, you need to have squirreled away enough money during the year to pay.

Some freelancers do their books themselves, some use apps such as QuickBooks or Xero. Personally, as soon as I made the decision to become self-employed I popped down to my local accountant and signed up. I figured I’d rather pay someone who properly knows what they are doing rather than faff around trying to do it myself and wasting time.

I had made that mistake with my website, I spent a couple of weeks building it… then a couple of years later just paid someone (who was a freelance web designer) to rebuild it. Because I would cringe whenever I looked at it.

That makes a good point actually, just because you can do something, doesn’t mean you should. Think about it, if I was really busy with work, where would I find time to do my books or rebuild my website? So potentially I could lose money or contracts or have to work evenings/weekends.

When I was made redundant, I created a limited company (FYI you don’t have to be limited to be a freelancer) and I bought my web domain. I then got to work promoting myself, thinking clients would be banging down the door to work with me. I posted on the socials, I sent out info packs to companies and I did a lot of ringing around.

Nothing. For 8 months. Nada. Zip. Zilch.

That’s one of the biggest challenges, getting the clients in when you first start. When you do get clients, hopefully, they will give recurring work rather than being ‘one build wonders’. So after some time, you wouldn’t have to hunt for work anymore.

I had no idea what to do or how to start, that’s where the eLN came in, I signed up and got myself a mentor. He really helped me to define what I wanted and gave me a plan of how I could get there. Another benefit of the eLN was I began to build my network of other people, freelancers, contractors, and employed.

- The biggest tip I can give you if you want to freelance is to build your network, not just connect on LinkedIn, really get to know people. For example, I’ve just taken on a client who was referred by a friend of a friend.

- The second tip would be to have a super fabulous portfolio as most people are asking for them now.

- My third tip would be to have enough money to not earn for several months, even a year. The more you have squirreled away the less pressure you’ll feel to creep back into employment or like me, start contracting.

Contracting

So after 8 months, I was called by an agency about a contract. The job was to develop GDPR training, had a decent day rate, and was only for 3 months. I figured why not try contracting for a while, being freelance clearly wasn’t working for me.

After earning a good wage for 3 months’ work, the contractor bug bit me. I took a month off and then jumped into another contract, this time for 8 months. Then straight into another one which was just over 2 years.

When I say ‘Contracting’, what does that actually mean? There are quite a few different types, some include:

- Fixed-term contract – where you are essentially employed by a company usually with all the same benefits for a certain amount of time.

- Retainer contract – where the company ‘book’ you for a set number of hours/days each month. This can also form part of your freelance work.

- Agency contract – where the agency posts the job and you apply. If you are successfully placed, they take a placement fee. This can be a finders fee paid by the company or a percentage taken off your daily rate. Often you complete a timesheet and send that to the agency each month.

- Direct contract – where you have not gone through an agency and invoice the company directly.

From April 2021 all public authorities and medium and large-sized clients outside the public sector are responsible for deciding if IR35 rules apply. In an article from the Federation of Small Businesses (FSB),

“IR35, also known as the off-payroll working rules or intermediaries legislation, is designed to make sure that that in an engagement, which is considered to be akin to an employment relationship, those working through their own companies, and their engagers (your clients), pay the same income tax and National Insurance contributions as those who are employed directly.”

This means a contract can be within IR35 or outside it, for example, my first contract was only 3 months so it would fall outside. My second contract was a small business, so that was outside too. My third was over 2 years in the public sector so that fell within.

What did this mean? I had to work through an umbrella company rather than invoicing the company directly as I had before. A bonus of this was I didn’t have to think about an annual tax or NI bill as I was essentially an employee, and there was a pension. But as it wasn’t a fixed-term contract so I didn’t receive any benefits like holiday pay.

Finding work through agencies is a lot easier than finding your own clients, but the day rates can vary greatly depending on the work and company.

- The first tip for day rate contracting is to check what deductibles are coming out of your day rate. Know what you will walk away with each day/month, it’ll save you being shocked when you get your first payslip.

- Second, ask the company if you can use their content in your portfolio. This is an important step that I have forgotten in the past. Just bear in mind you may need to alter some of the details, blur screens, or remove the company branding.

- The third tip would be to continue to network. I have to admit I’m really bad at this, as when I’m in a contract I am focused on the work. So if you see me popping up more on Twitter and LinkedIn it’s generally when I am not working.

Would I take another contract within IR35? To be honest, probably not as I still had my business overheads but the business technically wasn’t earning anything, so it was a bit of a nightmare for my accountant. Also, the umbrella company takes a fee, so you could be losing another bit from your day rate which you need to take into account.

In conclusion

After 3+ years of contracting, I was beginning to feel a little too ‘employed’. Don’t get me wrong, the work was good, the people were fantastic and I have learned a lot.

But I still have the dream.

To juggle multiple clients, to have the variation several clients can give, to set my own pace and decide how and when I want to work and with whom.

The freelance dream is still alive, and now I have my first client (hopefully recurring) I am on my way.

I hope you found my experience useful to help you make the decision about if self-employment is for you. If you have any questions you can find me on LinkedIn or the eLN Slack channel (you need to be a member of the eLN to join the Slack channel).